This is how Spanish original series performed on Netflix in the first months of the year.

This article is a translation of the Spanish article written by Elena Neira and published by Business Insider on August 4th. We echo this summer series of articles where she will be depicting the audience behaviour in global platforms every week with the use of our Digital-I and Think Data figures and analysis. You can read the original article by clicking the following link.

- In less than a decade, Spain has become an example of the impact that the production of local original content has on the overall strategy of global streaming platforms.

- This is the first article in a series that analyzes the performance of local original content production by streaming platforms in Spain during the period from January to May 2024.

- This article was created in collaboration with the technology and analysis company Digital-I (https://www.digital-i.com/), which specializes in the study of the television industries and other media, and The Film Agency, the agency responsible for Think Data (https://thefilmagency.eu/thinkdata/), an analysis and market trends solution for producers, sales agents, and distributors worldwide.

According to data provided by the European Audiovisual Observatory (https://rm.coe.int/investments-in-original-european-content-2012-2022-analysis-november-2/1680ad4699), Spanish productions represents 21% of the total expenses of streaming platforms on European content, second only to the United Kingdom, which boasts 31%. This number confirms the strategic importance of this territory for global OTTs.

The production of original Spanish content has not only allowed for greater diversity in the catalogs but also generated a better connection with the country’s audiences.

Every Sunday in August, we will analyze the performance of original Spanish content on global streaming platforms, as well as audience preferences in aspects such as genres or intellectual property.

Most Watched

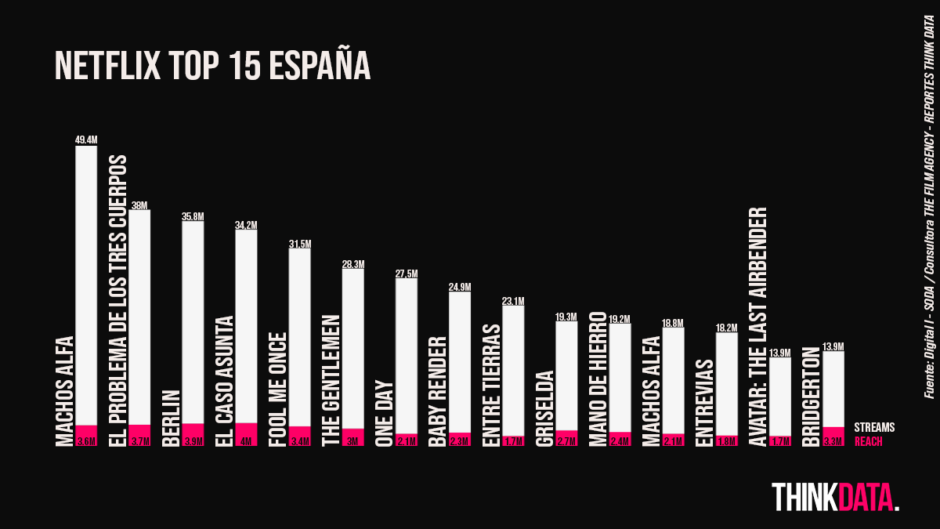

A quick look at the most-watched content between January and May 2024 shows that the production of original content by Netflix in Spain is achieving its goal of retaining its customer base. ‘El Caso Asunta,’ a true crime series that adapts the murder of the young girl Asunta Basterra at the hands of her parents, was the most-watched show among Netflix users during this period.

54% of all Netflix users in Spain watched this original, surpassing not only ‘Berlin’, the spin-off of the acclaimed show ‘La Casa de Papel’ (with a 53% penetration rate among service users), but also major productions such as ‘3 Body Problem,’ successful IPs like ‘Bridgerton,’ and the phenomenon ‘Baby Reindeer.’.

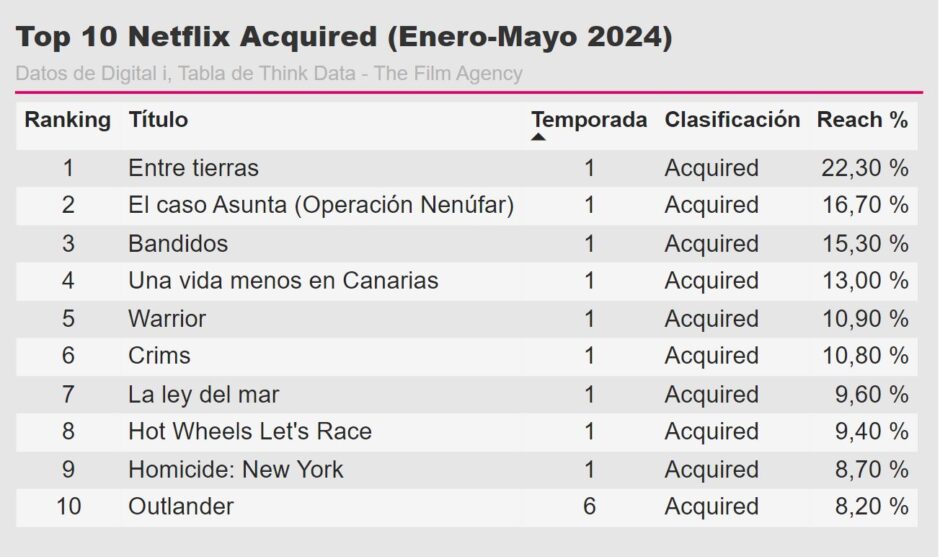

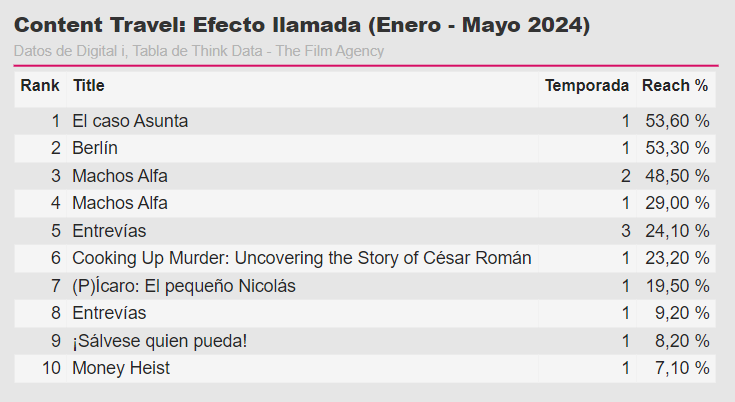

The chain reaction generated by successful shows over related content is one of the main conclusions that can be drawn when comparing this ranking with the Top 10 local original Spanish content and the Top 10 acquired content.

As reflected in Figures 2 and 3, ‘El Caso Asunta’ boosted the viewership of the documentary series that addresses the same topic (‘El Caso Asunta: Operación Nenúfar’). A similar effect is seen with the release of new seasons, which tend to pull in viewership for preceding seasons.

Therefore, the impact of the second season of ‘Machos Alfa’ increased viewership for the first season, and the premiere of ‘Berlin’ boosted viewership for the first season of ‘La Casa de Papel.’

As pointed out by Sophia Vahdati, Director of Marketing and Communications at Digital-I, Netflix’s homepage is a decisive dragnet in this regard. ‘With the release of spin-offs, new seasons, or even seasons released in two parts, Netflix increases the time a show or an IP is present on it.’

Without a doubt, this release dynamic benefits customer retention by enhancing the programming flow so that the customer doesn’t feel abandoned once a series concludes.

The appeal of glocal

The attractive factor of Spanish original content goes far beyond its capacity to satisfy local audiences. Netflix, in this sense, has demonstrated its ability to appeal to audiences from different countries, especially with Spanish productions.

Building on global phenomena such as ‘La Casa de Papel,’ ‘Lupin’, ‘Élite’, ‘El Juego de Calamar’, and the movie ‘El Hoyo’, the company has developed a specific line of content: the glocal – local due to their origin and, at the same time, global due to their distribution and subsequent performance, which is key to their strategy. “Netflix relies on this type of content to drive the innovative character of its brand”, points out Sophia Vahdati, Director of Marketing and Communications at Digital-I.

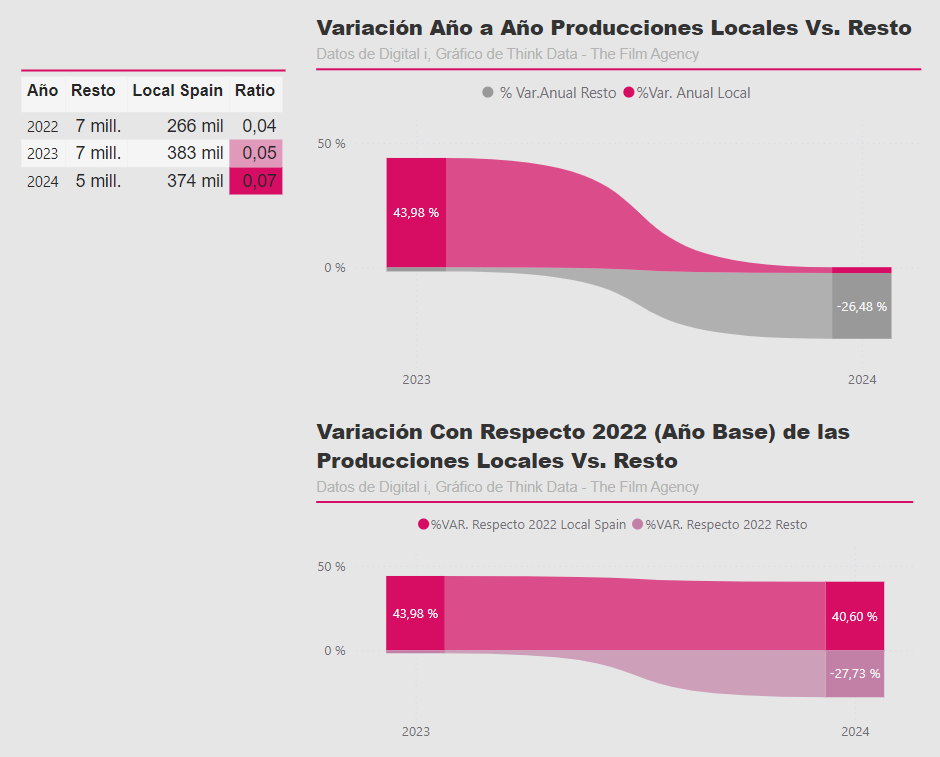

Original Spanish content has become a distinctive feature of Netflix’s editorial line. Furthermore, it has particularly benefited the company due to the potent string of tax incentives that exist in Spain. Although proportionally small in number, the quota that Spanish content represents within the rest of its catalog has grown steadily over the last few years.

This confirms the efficiency of this line of production, which has been particularly reinforced by the expansion of Netflix’s production center in Madrid Content City, the largest filming complex in Europe, and by the incorporation of new local partners in all regions of the country for the development of their projects.

What genres do Spanish viewers prefer?

Data from the first months of the year confirms that certain genres work really well in Spain. True crime, both in scripted and unscripted versions, obtains the best results among Spanish Netflix users, followed by historical drama and romance, in both comedic and dramatic tones.

“Spain has become a true creative powerhouse, producing diverse and adaptable content that resonates with audiences of all kinds.” says Celia Fumanal, Innovation Director at The Film Agency. “Netflix is producing solid and recurring intellectual properties (IP) that solidify this strategy as a fundamental part of its brand promise and to incentivize entertainment.”

Thrill, nostalgia, and laughter: this is the top 3 of Spanish original series on Netflix.

The top 3 most-watched shows on Netflix reflect the proficiency with which Netflix has specialized in three editorial lines:

-

-

- Local True Crime: Reviving the country’s dark past allows for the building of broad and complementary audiences. A show like ‘El Caso Asunta’ not only appeals to those who experienced the event firsthand but also to fans of the genre who are unfamiliar with the case. Additionally, there is a previous docuseries that helps to retain audiences: for those who first watched the true-crime series, the algorithm will recommend the docuseries, and vice versa.

- Successful Intellectual Properties: Nothing cements an intellectual property better than its narrative expansion, and when this expansion is carried out by one of the audience’s favorite characters, success seems guaranteed. ‘Berlin’ confirms that Netflix has no intention of letting the phenomenon of ‘La Casa de Papel’ fade. Given the show’s records, which have taken a risk by opting for a radically different tone from the source material, it’s clear they shouldn’t.

- Local Comedy: Comedy can be a universal genre, but also very local. ‘Machos Alfa’ fits into the latter category. It’s a show oriented towards fans of situational comedy, a favorite genre among the Spanish audience.

-

For Fumanal, the way Netflix is elevating various projects to the status of European hits demonstrates “a competitive strength that is hard to match.”

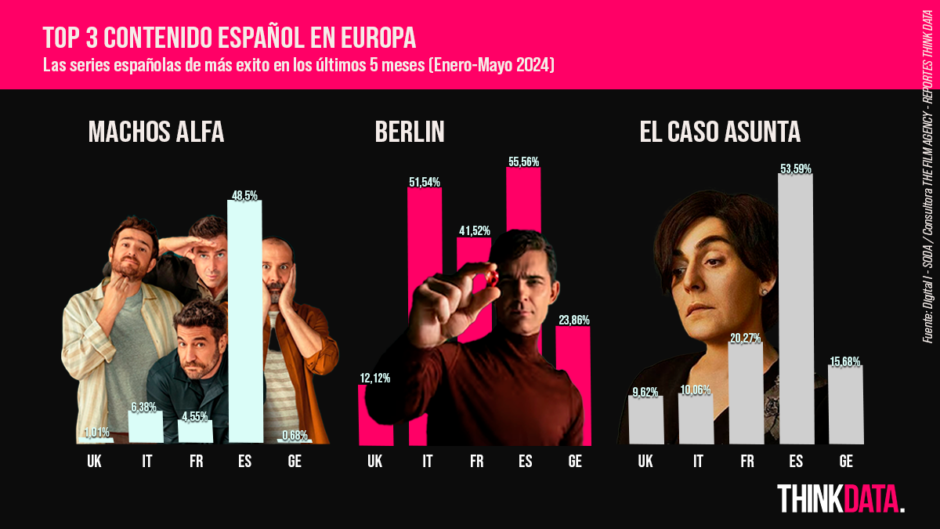

The strong performance recorded by these Spanish original productions displays a more irregular trajectory in other countries. The status of valuable intellectual property boosts the popularity of ‘Berlin’ in almost all the countries surveyed, with extraordinary consumption records among service users.

Meanwhile, ‘El Caso Asunta’ particularly capitalizes on the true crime genre in countries with high consumption statistics for this genre, such as Germany, France, Italy, and the United Kingdom. The content that encounters the most difficulty in circulation is ‘Machos Alfa,’ beyond culturally proximate countries like France and Italy.

Is Netflix meeting the demand of Spanish viewers?

Local original production has a broad and loyal audience in Spain. Netflix’s significant investment in the country checks all the boxes for attractive content: mid-budget productions, entirely shot locally (both on location and in their new studios at Madrid Content City), with a high consumption rate among service customers (often surpassing half of the national subscribers), and with potential appeal for viewers in other countries.

Netflix is undoubtedly taking “glocal” content to an unprecedented level of specialization, and for now, no competing platform seems to be able to match it.

About Digital-I data

Digital i collects viewing data from the four largest streaming platforms globally and across 20 world territories. With the consent of the panelists, they extract viewing histories from a representative panel managed through a proprietary app, and apply industry-favored statistical models to create estimates. In Spain, data is collected from a panel of 1,250 households every month.